crypto tax accountant canada

The Canada Revenue Agency can track your crypto investments. 295 Robinson St Suite 100 Oakville Ontario L6J 1G7 Forte Innovations.

Additional Business Services Tax Consultant Toronto

To create an e-Transfer order simply select a recipient and add the dollar amount you want the recipient to receive.

. Cryptocurrency is taxed like any. We also have a complete accountant suite aimed at accountants. Take the burden off.

We offer an extensive range of crypto taxation and accounting services. To create an e-Transfer order simply select a recipient and add the dollar amount you want the recipient to receive. Bull Bitcoin will generate a Bitcoin invoice for the amount you want to.

We handle all non-exchange activity. Book a call today to discuss your crypto tax situation and protect your. The regulation of Bitcoin taxes and other cryptocurrency taxes has raised questions for many taxpayers.

Best crypto tax accountant in canada SDG Accountant. In the summer of 2018 an international coalition of tax administratorsincluding the Canada Revenue Agency CRA and the United States Internal Revenue Service. You need to report both your income and capital gains from cryptocurrencies in your tax return to the CRA.

The tax return for 2021 needs to be filed by the 30th of April 2022. The cryptocurrency tax software called TaxBit is a crypto tax software that claims to help people with their tax filing for digital currencies. If this is you then its time to get help.

Bomcas Canadas professional tax accountants have a wealth of knowledge and hands-on experience in the realms of cryptocurrencies and blockchain technology which they bring to. Do you handle non-exchange activity. How is crypto tax calculated in Canada.

You have to convert the value of the cryptocurrency you received into Canadian dollars. TaxBit is a cryptocurrency tax software for Canada. We are leading crypto tax accountants in Toronto.

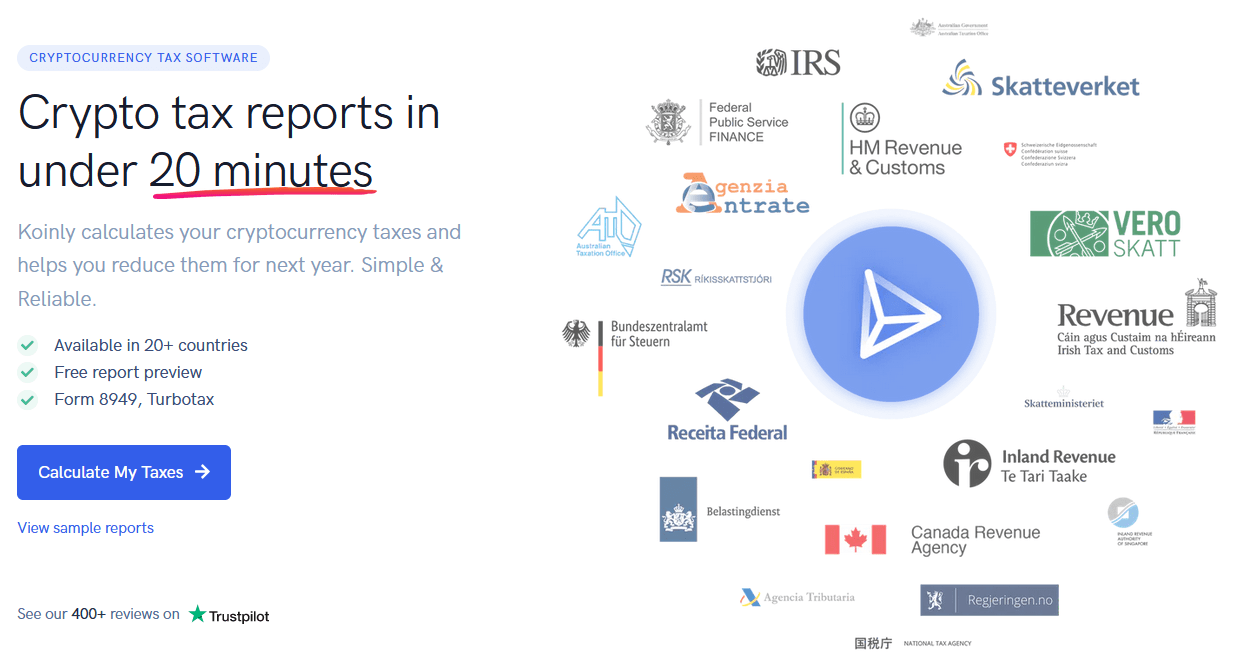

Koinly is a cryptocurrency tax software for hobbyists investors and accountants. Perhaps this is your first tax year with crypto asset gains in which case we will also help you with high quality reports from the start. Best crypto tax accountant in canada SDG Accountant.

This transaction is considered a disposition and you have to report it on your income tax return. Anyone who owns multiple exchange accounts or wallets knows the pains when it comes to declaring. Deixis is a Canadian accounting firm specializing in crypto tax and accounting services for Canadian investors.

The CRA announced theyre working with crypto exchanges to share customer information. Deixis is a Canadian accounting firm specializing in crypto tax and accounting services for Canadian investors. Our experts are well versed in calculating cryptocurrency transactions and its tax implications.

Combining our deep industry insights and cross functional. KPMG in Canada provides end-to-end cryptoasset and enterprise blockchain services from strategy to implementation. Get the most out of your cryptocurrency virtual currency Bitcoin and other blockchain-based finances.

For those wondering the Candian Revenue Agency has made it clear that yes Bitcoins and Cryptocurrencies need to be disclosed on taxes this year. Our directory of CPAs tax preparers and tax attorneys helps crypto traders help find a knowledgeable tax accountant for crypto tax advice planning and tax returns. Our clients can focus on their core business and leave crypto accounting services of crypto tax accountant Canada.

With our business-based approach to cryptocurrency accounting youll get the most. Cryptocurrency tax accountant Prepares cryptocurrency income tax returns calculates proceeds of disposition and Adjusted Cost Base ensuring its accurate.

8 Ways To Avoid Crypto Taxes In Canada 2022 Koinly

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

Cryptocurrencies Income Tax Implications In Canada Maroof Hs Cpa Professional Corporation Toronto

2022 Canadian Crypto Tax Guide The Basics From A Cpa R Bitcoinca

5 Best Crypto Tax Software Accounting Calculators 2022

Cryptocurrency Taxes In Canada Cointracker

Crypto Tax Accountant In Canada

Koinly Review Is It Good For Canadians May 2022 Updated

Cryptocurrency Tax Accountants Koinly

Crypto Currencies Reporting And Taxation Maroof Hs Cpa Professional Corporation Toronto

Canada Crypto Tax The Ultimate 2022 Guide Koinly

How To Cash Out Crypto Without Paying Taxes In Canada May 2022 Yore Oyster

5 Best Crypto Tax Software Accounting Calculators 2022

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Successful Accountants Tax Plan For Cryptocurrency Corvee

Best Crypto Tax Accountant In Canada Sdg Accountant